You just got your first job in Germany. Everything is ready—your contract is signed, and you’re set to start. But then, your employer asks for a Sozialversicherungsausweis, which is the German social security card. You stop and think—what is this card, and why do you need it?

In Germany, the Sozialversicherungsausweis is very important. It has your social security number (Sozialversicherungsnummer) and helps track your contributions to health insurance, pensions, and unemployment benefits. This card is essential whether you are an employee, a freelancer, or a student with a part-time job. Without it, you cannot work legally or access some social benefits.

This guide explains what you need to know about the German social security card. You’ll learn its purpose, how to get one, and what to do if you lose it. By the end, you will understand how this small card helps you be part of Germany’s strong social security system.

The Social Security Number

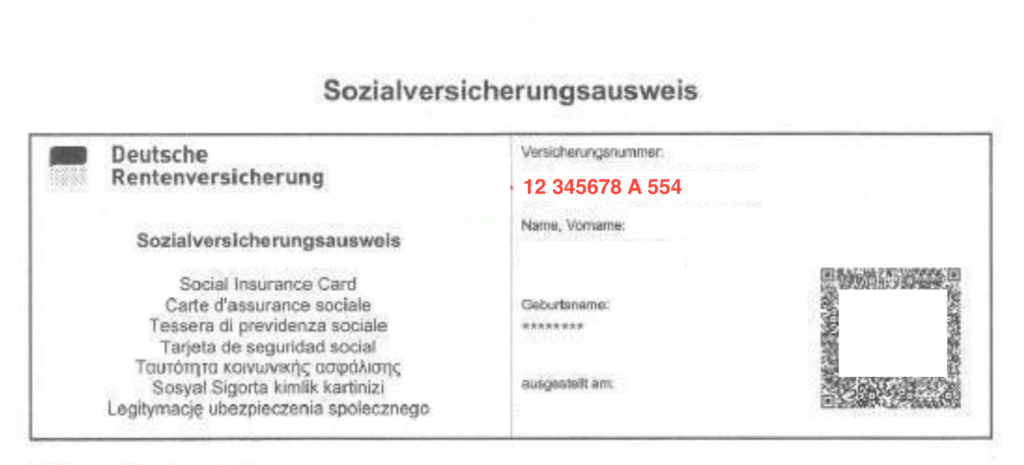

The Sozialversicherungsausweis, or German Social Security Card, is an important document. It shows your Sozialversicherungsnummer, which is your social security number. Each person in Germany who is part of the social security system receives this unique number. Unlike a tax ID, which is for taxes, the Sozialversicherungsnummer is used to track social security contributions. This includes contributions for pension, health insurance, and unemployment benefits.

This card is issued by the Deutsche Rentenversicherung (German Pension Insurance) and is required for all employees, including students working part-time and freelancers in certain fields.

Purpose

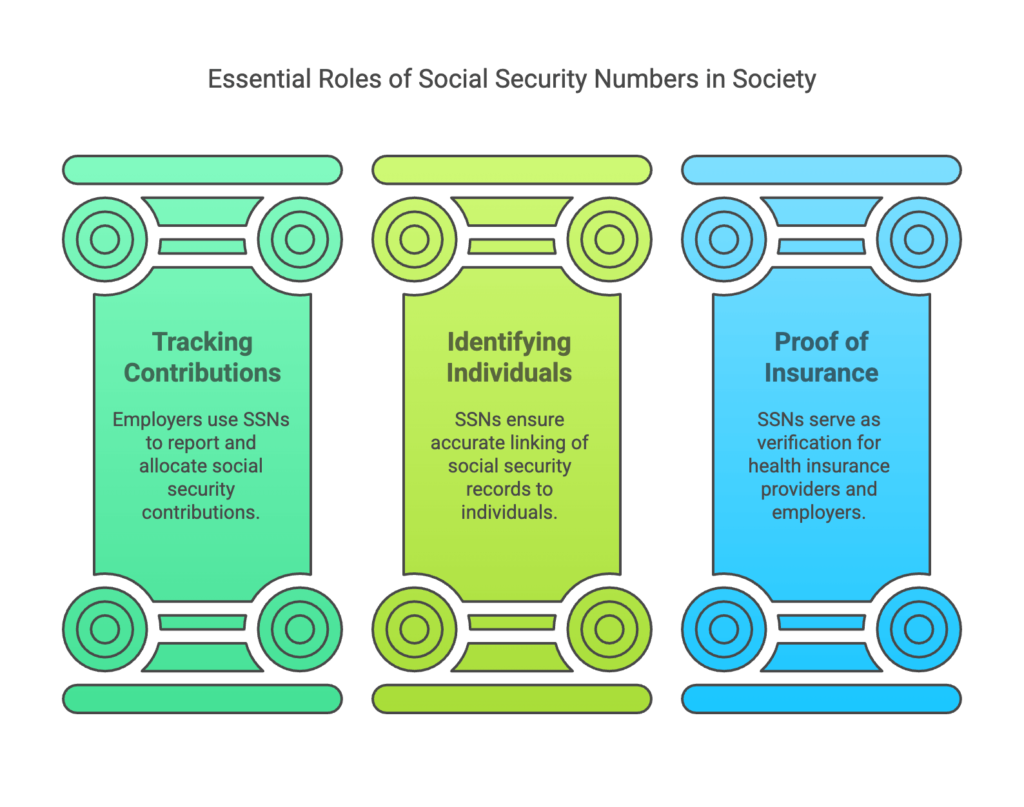

The Sozialversicherungsausweis serves several important functions in Germany’s social security system:

1. Tracking Social Security Contributions – Employers use the social security number to report and allocate payments for pension, health insurance, and unemployment benefits.

2. Identifying Individuals—This ensures that every worker’s social security records remain accurate and linked to the correct person.

3. Providing Proof of Insurance – In some cases, health insurance providers and employers may request the card as verification.

Without this document, an individual cannot legally work in Germany, as it is essential for employment contracts and payroll processing.

Key Information on the Card

The Sozialversicherungsausweis contains minimal but crucial details:

- Full Name – The legal name of the cardholder.

- Sozialversicherungsnummer – A unique 12-digit number assigned to the individual.

- Issuing Authority – The Deutsche Rentenversicherung, which manages pensions and social security records.

The card does not include a photo or an expiration date. It is a simple document, typically printed on plain paper, but it holds significant importance in Germany’s employment system.

How to Obtain Your Sozialversicherungsnummer

A. Step-by-Step Process for Applying for a Social Security Number

If you work in Germany for the first time, you must obtain a Sozialversicherungsnummer (social security number). Here’s how to get it:

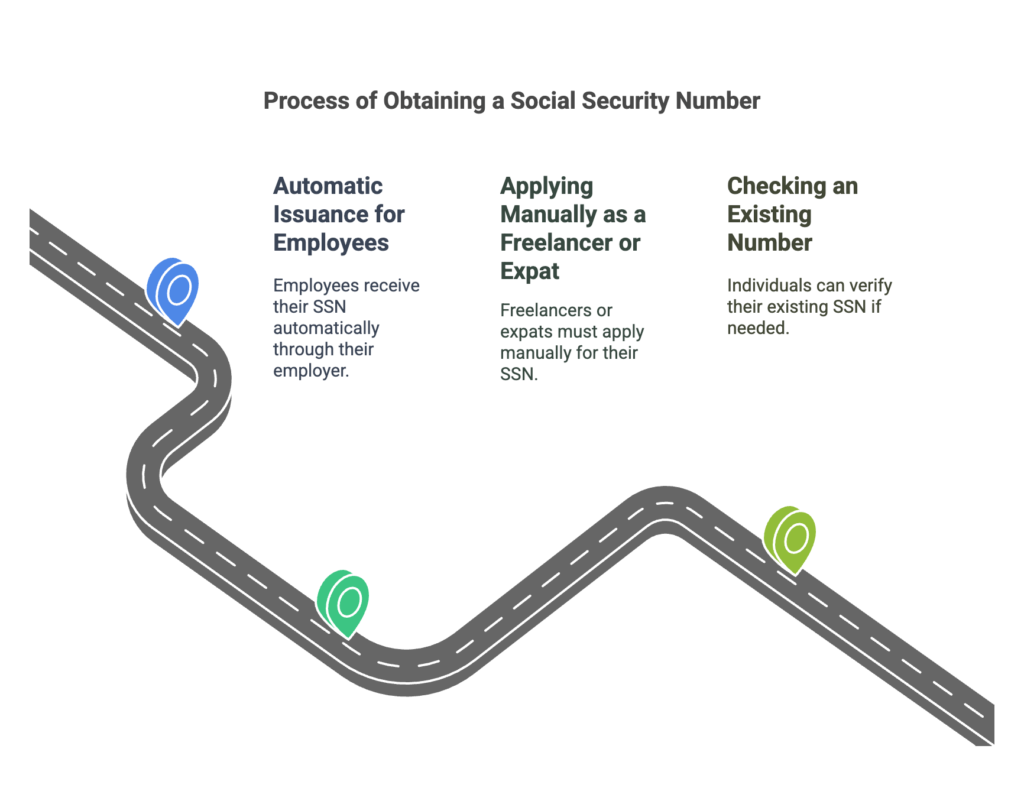

1. Automatic Issuance for Employees

- If you are employed, your employer will register you with a statutory health insurance provider (Krankenkasse).

- The health insurance provider will request your Sozialversicherungsnummer from the Deutsche Rentenversicherung (German Pension Insurance).

- You will receive your Sozialversicherungsausweis (social security card) by mail.

2. Applying Manually as a Freelancer or Expat

- You can apply directly if you are self-employed or need the number before employment.

- Contact the Deutsche Rentenversicherung or your statutory health insurance provider to request your number.

- Submit your application online, via phone, or by visiting a local office.

3. Checking an Existing Number

- If you have worked in Germany before, you may already have a Sozialversicherungsnummer.

- Check previous documents, such as payslips or insurance records.

- If lost, request a duplicate from the Deutsche Rentenversicherung.

Required Documents and Information Needed for the Application

To apply for your Sozialversicherungsnummer, you will typically need:

- Valid passport or residence permit

- German address registration (Meldebescheinigung)

- Health insurance details (if applicable)

- Employer’s details (if employed)

- Tax identification number (Steuer-ID), if available

Where to Submit the Application and Expected Processing Times

- For Employees: Your employer handles registration with the health insurance provider, which requests your number.

- For Freelancers and Expats, you can apply through Deutsche Rentenversicherung (German Pension Insurance), your statutory health insurance provider, or Customer service centres (Bürgeramt) in some regions.

Processing Time:

Your Sozialversicherungsausweis is usually sent by mail in 2 to 4 weeks. If you need it urgently, you can request a confirmation letter from your insurance provider.

Locating Your German Social Security Number

One of the easiest ways to locate your social security number is by checking your Sozialversicherungsausweis (social security card). This document, issued by Deutsche Rentenversicherung, contains your number and should be kept safe. If you cannot find the card, your monthly payslip (Gehaltsabrechnung) might have it listed. Employers often include this number in salary documents for administrative purposes.

Importance of Keeping This Number Secure and Accessible

Keeping your Sozialversicherungsnummer secure is essential because it is used for tracking pension contributions, registering for social security benefits, and processing employment records. Losing this number can cause delays in employment paperwork and social security benefits. It is advisable to store your Sozialversicherungsausweis safely and keep a copy for easy reference.

Have you Lost Your Social Security Number?

Losing your card isn’t the end of the world. Here’s how to replace it:

- Contact your health insurance provider to report the lost card and request a replacement. Provide necessary details like your name and social security number for verification. Submit the official application for a new card, which may include filling out specific forms. Finally, wait patiently for the replacement card to arrive by mail.

- Submit a request for a replacement card.

Submitting a request for a replacement card involves contacting your health insurance provider to inform them about the lost card and verifying your identity. You may need to fill out a specific form or application. Once the request is processed, a new card will be issued and sent to your registered address. - Wait for the new card to arrive by mail: Once your application for a replacement card is submitted, the processing time varies depending on your health insurance provider. Generally, the new card takes a few weeks to arrive at your registered address. Ensure your address is up-to-date to avoid any delays in receiving your card.

Role of Techniker Krankenkasse (TK) in Social Security Numbers

Explanation of TK and Its Services Related to Social Security

Techniker Krankenkasse (TK) is one of Germany’s largest statutory health insurance providers (Krankenkasse). It plays a crucial role in social security by ensuring that insured individuals have access to healthcare and other benefits. TK, like other public health insurers, also helps employees register for social security when they start working.

As part of its services, TK coordinates with Deutsche Rentenversicherung to facilitate the issuance of a Sozialversicherungsnummer (social security number) for new employees. When an individual is insured with TK, the organization submits a request for a social security number on their behalf if they do not already have one. This process ensures that employees can start working without delays in social security registration.

Clarification on Whether TK Provides Social Security Numbers

TK does not generate or issue social security numbers. Instead, it acts as an intermediary between employees and Deutsche Rentenversicherung, the official authority responsible for issuing the Sozialversicherungsnummer. When an employee registers with TK for statutory health insurance, TK forwards the request to Deutsche Rentenversicherung, which then issues and mails the social security number to the individual.

If someone has lost their social security number, TK can assist by verifying the existing number and providing a confirmation. However, if a replacement document is needed, individuals must contact Deutsche Rentenversicherung directly to request a duplicate Sozialversicherungsausweis.

How to Contact TK for Assistance Regarding Social Security Matters

Individuals insured with TK can reach out for assistance with social security-related inquiries, including confirming their social security number or requesting guidance on registration. TK offers multiple contact options:

- Phone: TK’s customer service hotline is available at 0800 285 85 85 (within Germany) or +49 40 4606 62 901 (from abroad).

- Online Portal: Insured individuals can log in to their TK account via the official website, www.tk.de, and send inquiries.

- Local TK Offices: TK has service centres across Germany where individuals can visit in person for assistance.

Can You Apply Without an Employer?

If you’re self-employed or need a Social Security Number in Germany for other purposes, you can directly approach a German statutory health insurance provider. They will guide you through the application process, ensuring you meet the requirements and provide all necessary documentation to obtain your social security number efficiently.

Understanding the Structure of the Social Security Number in Germany

Your Social Security Number in Germany consists of 12 digits:

First digits: Birth region

Middle digits: Birthdate and gender

Last digits: Unique identifier

Social Security Contributions Explained

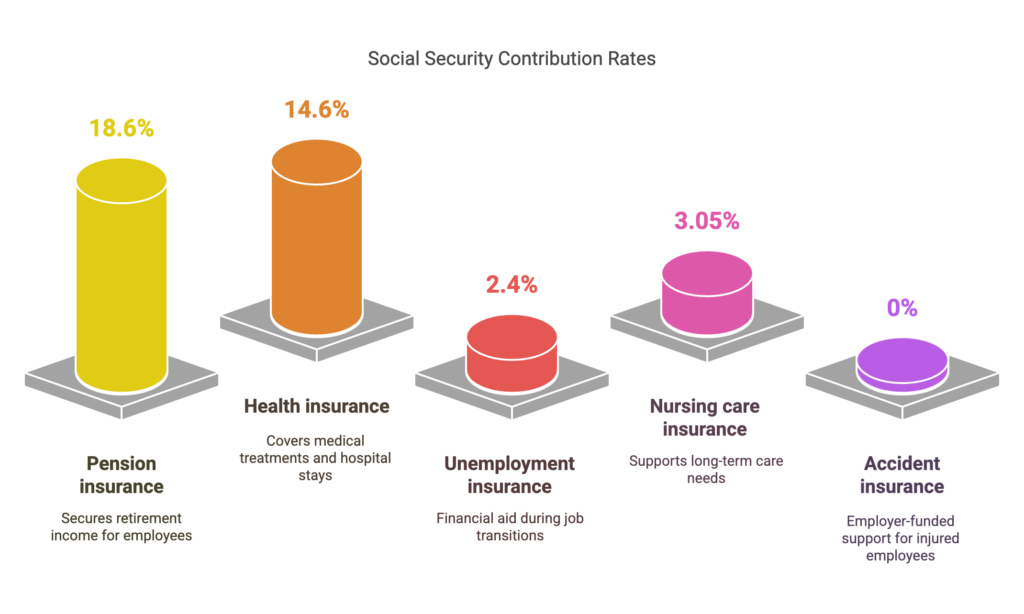

Both employers and employees contribute to the social security system. Contributions are deducted directly from your paycheck.

- Pension insurance: 18.6%

Employees contribute to the pension system to secure their retirement income. Employers also match this contribution. - Health insurance: 14.6%

Health insurance covers medical treatments, consultations, and hospital stays, ensuring comprehensive healthcare. Employers share this cost. - Unemployment insurance: 2.4%

This provides financial aid during job transitions, helping employees stay afloat while seeking new opportunities. - Nursing care insurance: 3.05%

Supports individuals requiring long-term care due to age, illness, or disabilities. Both employer and employee share the contributions. - Accident insurance: Paid fully by the employer

This ensures financial and medical support for injured employees, covering rehabilitation and recovery costs.

Key Takeaway

Obtaining a social security number is straightforward. It is automatically assigned when an individual registers with a statutory health insurance provider, such as Techniker Krankenkasse (TK). Individuals can retrieve their number through pay slips, official documents, or by contacting Deutsche Rentenversicherung if needed. Securing this number is crucial to avoid employment and social security-related delays.

Understanding the role of health insurance providers like TK in facilitating social security registration can help employees and self-employed individuals navigate the system smoothly. Whether you are applying for the first time, locating a lost number, or seeking assistance, knowing where to go and whom to contact ensures a hassle-free experience.

FAQs About Social Security Numbers

1. Is the Social Security Number Permanent?

Yes, your social security number is valid for life.

2. Can I Work Without a Social Security Number?

No, you must have one before starting legal employment in Germany.

3. What Happens if My Employer Doesn’t Register Me?

You should contact a health insurance provider to initiate registration yourself.

4. Can I Have Multiple Social Security Numbers?

No, each person is assigned a unique number for life.

5. Is My Data Secure?

Yes, Germany has stringent data protection laws to keep your information safe.